LENDER KNOWLEDGE

We have in-depth knowledge of lenders and their lending criteria

We have in-depth knowledge of lenders and their lending criteria

We'll do all the legwork so you can concentrate on your move

We can offer a protection solution that fits your needs and circumstances

We know who to speak to at the lender institutions to move things along

You'll meet and deal with just one person throughout your application

Whole of Market lender access in the truest sense

We can find a lender with lending criteria that suits your circumstances

Everyone is different, with a unique set of financial and life circumstances, and as a result it is possible that you won't have access to all the lenders in the market.

Instead of "going-it-alone", utilise our knowledge of the market to find a lender appropriate to your needs and circumstances. Our service could prevent you from making unsuccessful applications, and expending valuable time in the process.

Let us take care of your mortgage application from start to completion, so you can concentrate on the logistics of finding and moving in to your new home

If anything in life is certain, then you can be sure that moving home is going to give you some fraught moments! Spending hours on the phone chasing up your mortgage application is quite possibly the last thing you need! So let us do it for you.

After 1 or 2 face-to-face meetings we can handle every aspect of your application, from income verification to I.D checks. We then submit the information to your prospective lender, and follow up to progress it through to a formal offer.

Our advice isn't limited to mortgages. We can design a protection solution to suit your needs and circumstances

A mortgage is a significant financial commitment, and we can advise you on one or a combination of products that can protect your home should you fall victim to adverse life events.

With access to Life Insurance, Critical Illness, Income Protection Benefit, and ASU (accident, sickness, unemployment) products, we can recommend a solution that is tailored to your mortgage commitment and wider circumstances.

AS WITH ALL INSURANCE POLICIES, CONDITIONS AND EXCLUSIONS WILL APPLY

We have the relationships required to make your application a smoother process

As a leading mortgage intermediary, we have dedicated account representatives within the lending institutions.

This means that we have a defined point of contact to refer to when progressing your application, so we know the status of your application and what might need to be done to keep it moving through the underwriting process. Our relationships with lenders and key personnel can result in a more efficient application process.

Personal service makes all the difference in compiling a mortgage application that is likely to be successful

Dealing with a lending institution directly does’t often allow you the same personal service that can ease the pressure when you have uncertainties, and questions to ask.

Rest assured that your case manager will be in your corner, and on hand to give you advice and reassurance as and when you need it.

We have unrestricted, Whole of Market lender access which exceeds that of many other mortgage broker firms

We also have access to lenders who only allow trusted partners to refer borrowers to them. These are referred to as "limited distribution" lenders.

This extended lender access means we have more providers to choose from in finding lending solutions for our clients.

Good advice isn't based on jargon and fancy words. We'll explain things in an easily understood way

We will always make ourselves available to answer your questions, and to keep you updated on your application

Our obligation is to advise, not to sell, and we will uphold our duty to act in your best interests at all times

We treat all personal information with care, and in accordance with the data protection act

We will make the mortgage application on your behalf and progress it through to completion

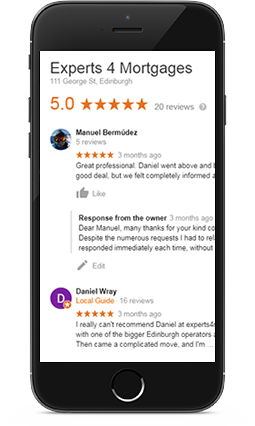

To take your feedback as an opportunity to improve your experience and the experience of future clients

"Experts 4 Mortgages guided us every step of the way in making our first home purchase, finding the right lender for a situation where one of us is a business owner. In retrospect, we actually needed the help of a good broker"

There may be a fee for arranging a mortgage and the precise amount will depend on your circumstances. This fee is typically £295. Experts 4 Mortgages is a trading style of Daniel McLardy, who is an Appointed Representative of Stonebridge Mortgage Solutions Ltd which is authorised and regulated by the Financial Conduct Authority. We are entered on the Financial Services Register under firm reference number 814866

PLEASE OBSERVE THE FOLLOWING RISK WARNINGS

MORTGAGES: Your home may be repossessed if you do not keep up repayments on your mortgage

EQUITY RELEASE: A lifetime mortgage is a long-term commitment which could accumulate interest and is secured against your home. Equity release is not right for everyone and may reduce the value of your estate. Equity Release is by referral only

© All Rights Reserved Experts 4 Mortgages